The “Economic and Financial Impacts of the Draft Transition Plan for BC Salmon Farms” is an analysis of the economic and financial impacts of a ban on marine net-pen salmon farming as proposed in the Government of Canada’s Draft Salmon Aquaculture Transition Plan for British Columbia, September 2024.

Going directly to a ban by 2029 will result in significant long-term negative socio-economic impacts in British Columbia and Canada. It will reverse and harm once positive Indigenous economic development and reconciliation efforts and severely impact employment in areas with a history of underemployment. An unjustified ban and push to unproven technology on salmon farming in B.C. will reduce Canadian agri-food production by 400 million healthy meals per year, eliminate B.C.’s top agri-food export, destroy 4,560 jobs, and cost Canadian taxpayers at least $9 billion.

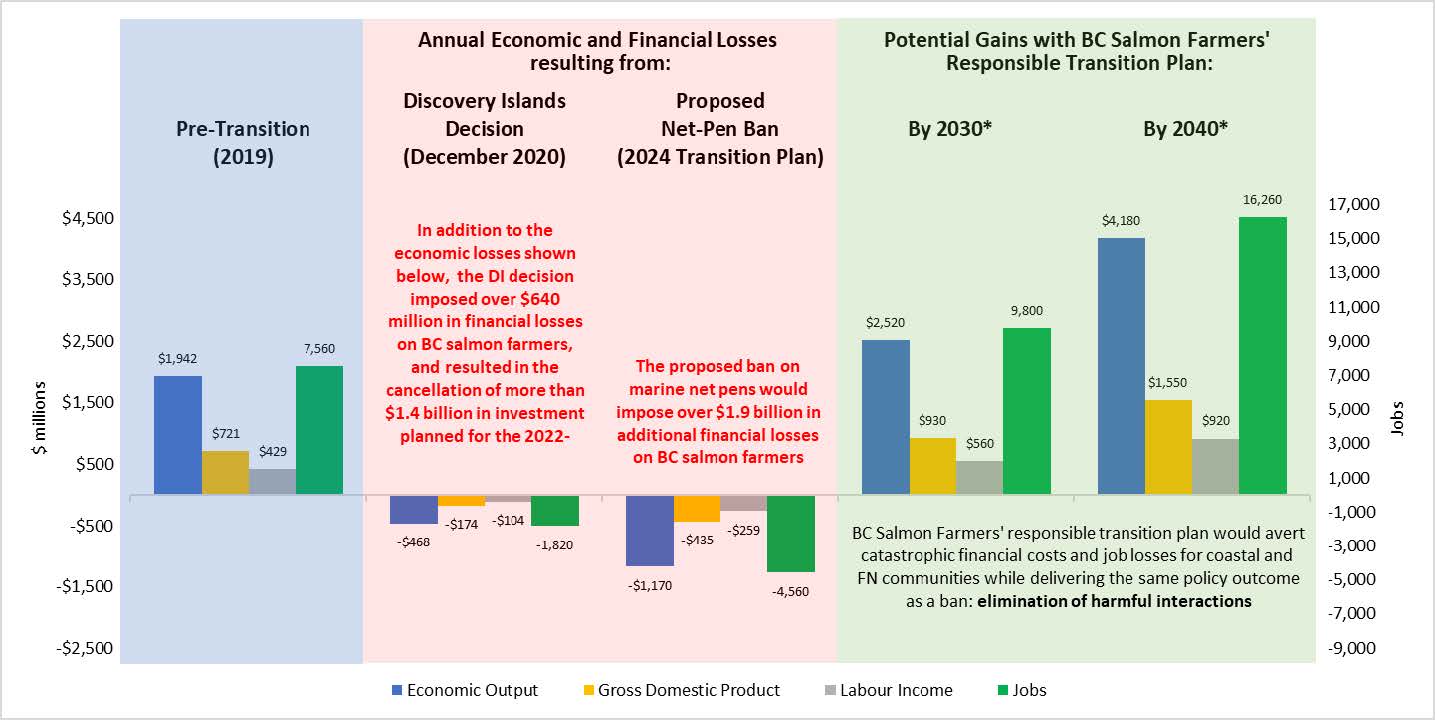

The anticipated impacts of the ban are as follows:

1. Loss of $1.17 billion in annual economic activity, $435 million in GDP, and 4,560 fewer well-paid full-time jobs with a combined annual payroll of approximately $259 million.

2. Loss of $437 million in spending with over 1,400 vendors across B.C.

3. Elimination of a further 50,000 tonnes of farmed salmon production.

4. Reverse meaningful Indigenous reconciliation, self-determination and rights and title for impacted First Nations.

5. Devastation to several rural, B.C. coastal communities—the removal of this critical industry for Vancouver Island, with an average salary that is 30 percent higher than the median employment income, takes away meaningful career opportunities and the ability for rural, coastal, and Indigenous communities to attract and retain their youth.

6. Impose unnecessary costs on Canadian taxpayers of at least $9 billion to compensate for the industry’s closure and to subsidize unproven closed containment tech companies.

7. It ignores the existing responsible plans of B.C. salmon farmers and First Nations to minimize further interactions between farmed and wild salmon – which would deliver the same policy outcome as the ban without the devastating consequences for coastal and Indigenous communities.

8. Contradicts the government’s own policies, resulting in the complete loss of investor confidence in Canada to invest in new innovations and technologies.

Figure 1. BC Salmon Farming Impacts, Canada-wide

*Growth scenarios are based on company projections of potential recovery of production under the responsible transition plan.